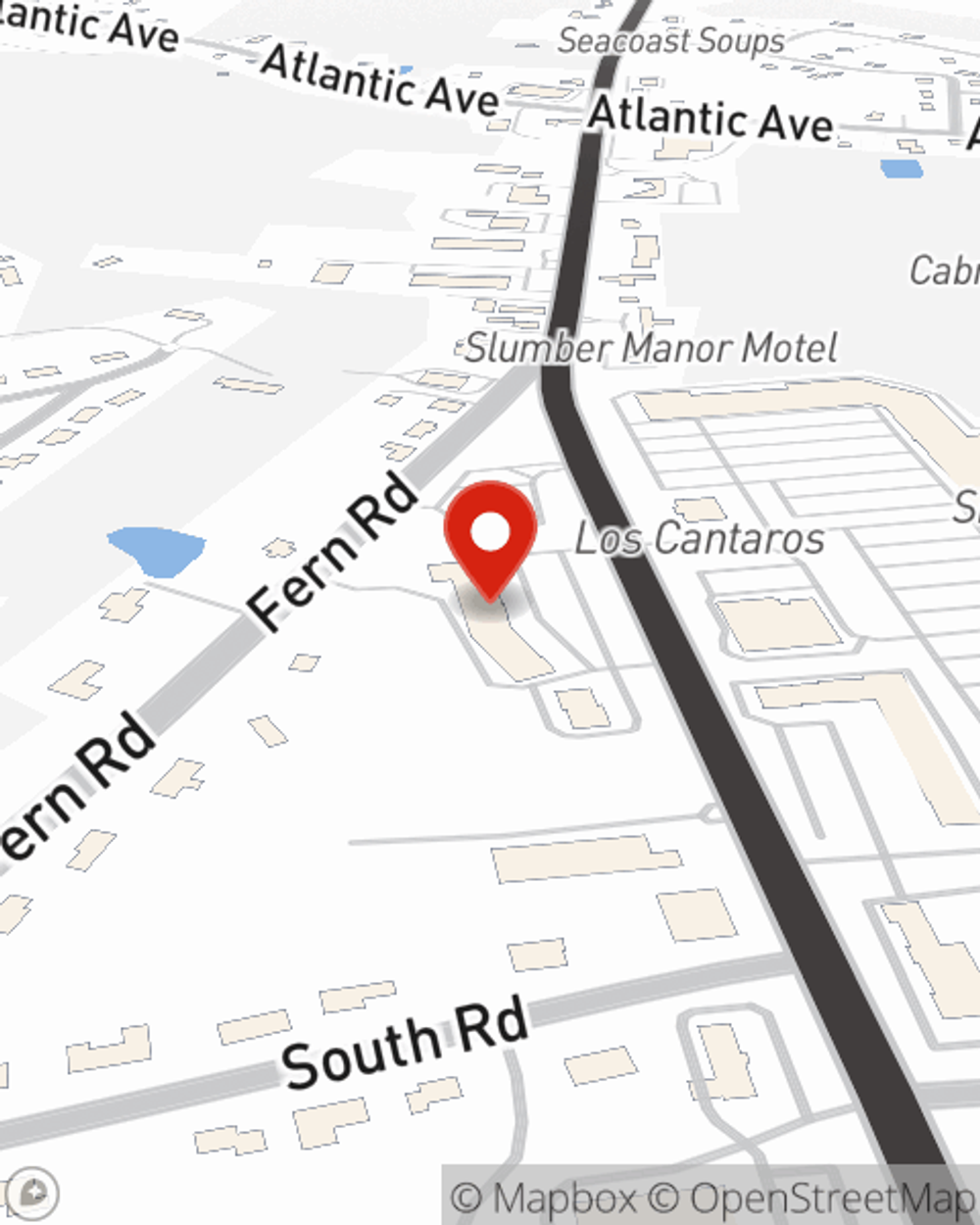

Insurance in and around North Hampton

Great insurance with your good neighbor

Insurance that works for you

Would you like to create a personalized quote?

Find The Insurance Protection You Need At State Farm.

We can help you create a Personal Price Plan® to help protect what’s important to you – family, things and your bottom line. From safe driving rewards, bundling options and discounts*, shape your coverage to meet your specific needs. Contact Tony LeClerc for a Personalized Price Plan.

Great insurance with your good neighbor

Insurance that works for you

Got A Plan? Let Us Help You Get There

Some of these excellent options include Life, Condo, RV and Business insurance. Not only is State Farm insurance a great value, but it's a smart choice.

Simple Insights®

Key reasons why you should never leave pets in hot cars

Key reasons why you should never leave pets in hot cars

Can you leave your dog in a hot car with the windows cracked or A/C running? Safety tips all pet owners should know before leaving dogs or cats in hot vehicles.

Day of the Dead

Day of the Dead

Discover Day of the Dead, its traditions and its origins, as well as how to decorate your home and celebrate the date safely this November.

Tony LeClerc

State Farm® Insurance AgentSimple Insights®

Key reasons why you should never leave pets in hot cars

Key reasons why you should never leave pets in hot cars

Can you leave your dog in a hot car with the windows cracked or A/C running? Safety tips all pet owners should know before leaving dogs or cats in hot vehicles.

Day of the Dead

Day of the Dead

Discover Day of the Dead, its traditions and its origins, as well as how to decorate your home and celebrate the date safely this November.