Renters Insurance in and around North Hampton

Renters of North Hampton, State Farm can cover you

Renters insurance can help protect your belongings

Would you like to create a personalized renters quote?

Protecting What You Own In Your Rental Home

Home is home even if you are leasing it. And whether it's a house or a townhome, protection for your personal belongings is a good idea, even if your landlord doesn’t require it.

Renters of North Hampton, State Farm can cover you

Renters insurance can help protect your belongings

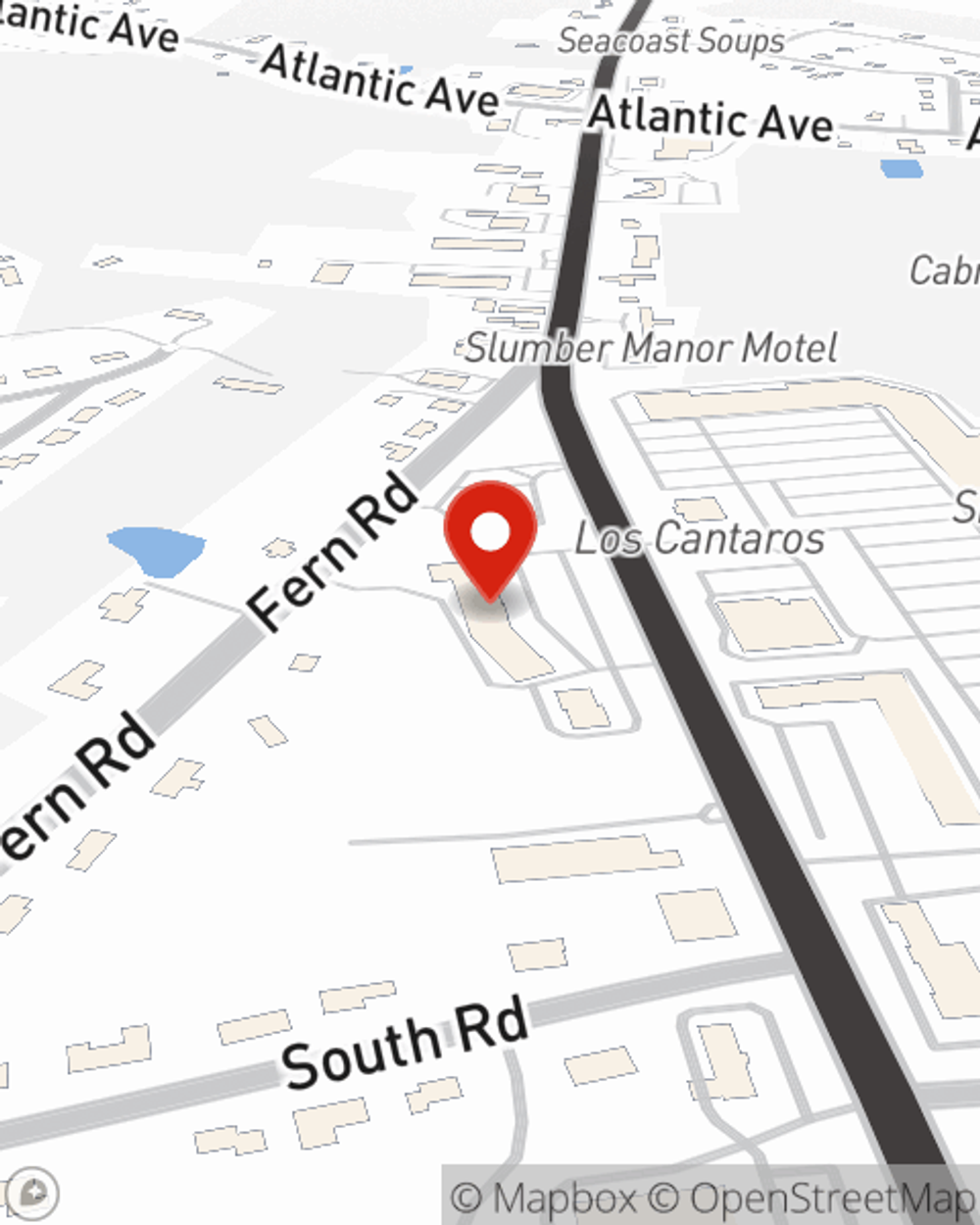

Agent Tony Leclerc, At Your Service

It's likely that your landlord's insurance only covers the structure of the property or home you're renting. So, if you want to protect your valuables - such as a dining room set, a bed or a microwave - renters insurance is what you're looking for. State Farm agent Tony LeClerc has a true desire to help you understand your coverage options and insure your precious valuables.

A good next step when renting a condo in North Hampton, NH is to make sure that you're properly protected. That's why you should consider renters coverage options from State Farm! Call or go online now and find out how State Farm agent Tony LeClerc can help meet your renters insurance needs.

Have More Questions About Renters Insurance?

Call Tony at (603) 964-5556 or visit our FAQ page.

Simple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.

Tony LeClerc

State Farm® Insurance AgentSimple Insights®

How to deal with noisy neighbors or issues

How to deal with noisy neighbors or issues

From noisy neighbors and arguments over property lines to adventurous pets, there are ways to successfully resolve disputes between neighbors.

Tips for renting a storage unit

Tips for renting a storage unit

Tips for selecting a rental storage unit, packing personal possessions, insurance for storage and how do storage units work.